730 Is My New Favourite Number for FinOps, Can You Tell Why?

730 is a powerful math shortcut for FinOps. Learn how to use it to translate hourly rates in cloud pricing into average monthly costs, normalize trends across uneven months, amortize commitments, and do quick forecasts. A tiny constant with an outsized impact on clarity and accuracy.

I posted this question a while back to FinOps folks. I got a lot of great answers in comments. Thanks to all of you who have reacted! Let me summarize the learning here in this knowledge nugget (bite-sized blog post).

First, let's clarify what 730 is:

730 is the number of hours in an average month.

And here is how to calculate it:

First, the number of hours in a year is :

365 days x 24 hours = 8760 hours

Then, divide this by 12 to get the hours in an average month:

8760 hours / 12 months = 730 hoursI have put the word average before 'month' for a reason.

Months have different lengths, varying between 28 and 31 days. Suppose you compare January to February without adjusting for the number of days in each month. In that case, your difference is a whopping 8.7% drop from January to February. In reverse, January has 10.7% more days than February. Not a negligible difference for comparing monthly values in business.

Skip the next paragraph.

You like to split hairs? Yes, I know. February goes up to 29 days in leap years (except every 400 years), but let's jump over this for the sake of simplicity. You celebrate your birthday every year, even if you were born on 29 February, don't you?

So, who likes to be average?

730 does. And I like 730's averageness. It allows me to use it for quick napkin calculations of monthly costs of cloud services, where the unit rate is most often given for an hour (but sometimes billed by the second).

Like compute.

Like, compute is often the top item in your bill, too!

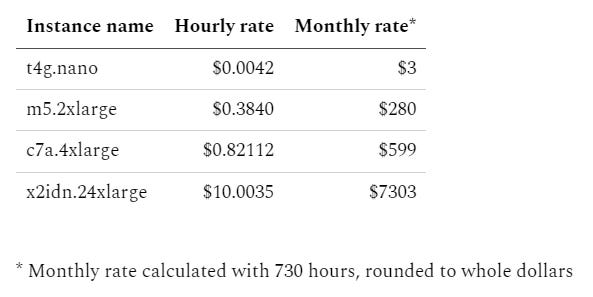

When I look at those tiny fractional compute unit price figures, for example, $0.0042, with the supernumerous zeroes, my eyes are getting wet, the balls are falling out, and the cogwheels in my brain start to squeak.

Bring 730 to the rescue!

Do the life-saving multiplication and let the bigger numbers save our souls. Honestly... which one is easier to grasp and compare?

Marketing loves obscure stuff. Like $99.97 instead of the $100 bucks straight-talk. A scientific kind of deception. A bit of a grey zone. Sometimes borderline fraud. Watch out for yourself and do the math that makes your life easy.

Back to 730.

The good news is that the heavyweight providers have also realized the usefulness of 730 and use it in their pricing calculators. Words matter. They are not cost calculators, as that could leave a bitter aftertaste.

A word of warning.

Different providers use different numbers for what a month is. Just make sure to check out and compare figures accordingly.

What else is 730 useful for?

You can use it to normalize your monthly cost figures for comparison. In contrast, normalizing for 30 days will rip 5 days off the year (-1.37%) since 12 x 30 is just 360 and not 365. Another good option for comparison is to work with daily averages or daily consumption rates.

You can also use 730 to amortize your costs. Just divide your equal monthly payments (e.g., commitment fees) by the figure and apply to all days throughout the 365 days of the year.

Additionally, you can use it for extrapolation and perform simplified forecasts and planning estimations. Multiply the 730-hour-based monthly cost by 12, and you get an exact annual figure for 365 days.

I even got an insightful suggestion of its usefulness as the Time To Live (TTL) for non-critical environments. Nice one! Even so, Time to Live is a loaded expression. Even philosophical. But I will not cross that boundary here.

I hope you learned something and enjoyed it! That’s my pleasure!

Don't forget to share your feedback with me!